Is an investment property a gorgeous home at the beach overlooking the surf, a place by the lake, that nice house across the street, a high rise condo on the strip or the little old two bedroom cottage in the slightly transitional location downtown?

Well, the answer invariably depends upon the PURPOSE of the investment and how it fits into your goals and Property Plan. So, depending upon your investment objectives it could be all or none of the above!

As people are emotional, one of the great things about property is pride of ownership. You can see it, feel it and even enjoy its use. Yet a property investment is primarily a means to an end and identifying that end and determining how to get there is key.

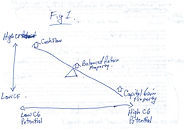

All investments fall somewhere along a sliding scale, with one end focused on cash flow, tilting towards balanced returns in the middle and capital growth focused investments at the other end. Determining your desired mix of cash flow verses future capital gain is the first step and really determines the focus of your property search. Typically Cash Flow properties have high cash flow and low cash gains potential, progressing to Cash Gain properties with high cash gains potential but low cash flow returns.

Let's examine Cash Flow, Balanced Return or Capital Gain property, how they differ and what are their positives and negatives? The three revolve around rental income, purchase price and future price gains.

CASH FLOW

Cash flow properties consistently generate very high rental income (high ROI) but the prospect of large capital gains tend to be low. Cash flow property’s biggest negative is that capital gains may be sacrificed for regular cash flow.

Townhomes in Gated Communities can generate great returns but check the HOA fees (photo caption)

Cash flow properties are often smaller, less well located (think C to B locations), lower priced condos, town homes or starter houses because lower purchase price increases the ROI. These investments are often purchased for cash, paid off quickly, and leave a substantial monthly profit after mortgage expenses. Regular costs such as Home Owner Association (HOA) fees need to be minimized to keep net ROI high. See the cash flow property examples and compare the gross verses net return of each property type. This difference is mainly because of the HOA.

Cash flow focused investments are good for anyone needing to increase or supplement income. Younger people starting out, a single parent needing extra income, a family planning the reduction in income of a partner, an acrobat looking to replace an income by a certain age, a person or couple approaching retirement needing fixed income or anyone in a lower tax bracket looking for a little extra!

BALANCED RETURN

Balanced Return properties blend both attractive rental income today and good prospects for future capital gains. They normally have lower ROI’s than cash flow properties but have a larger probability of capital gain.

Great Pools and Yards can be found in Balanced Return Properties

Balanced Return properties tend to be well located, in good school districts, Single Family Residence’s (SFR) between 1200SF – 2400SF, 3 – 5 bedrooms and 2 – 3 bathrooms. A higher percentage will be financed than bought with cash. Many have additional features such as 3 car garage, spa, pool or patio area that add additional emotional element and help make a house a home.

Different property types within the balanced return category allow for an individual weighting towards cash flow or capital gain focus. Over sixty percent of the US property market is focused on SFR starter homes, for families getting started, mature people downsizing, singles and couples. These homes are typically 1200SF – 1600SF with 3 beds and 2 baths on their own block of land. These are the most ‘in demand’ property type and the safest long term bet for rental and resale.

Las Vegas home prices are primarily determined by a home’s square footage (SF). If you buy a track home in a housing estate, (which is most) your home’s value is largely determined by multiplying your home’s square footage by the price per square foot in the area. If homes are selling at $150 per SF and you have a 1500SF home, your property is worth about $225,000. There is a plus or minus 15% variation for condition and special features so your range would be $190,000 - $260,000. It doesn’t matter if you spent $60,000 adding a pool, spa, basketball court or tennis court, the home’s resale and appraisal value for a loan, will max out about 15% above the average price of the area. Take a look at the Balanced Return (BR) starter home examples.

If you want good rental returns but wish to focus a little more on capital gain then you need to buy a home with a larger square footage. But there is a resistance point as we examine larger homes where the price per square foot starts to become discounted and rental returns diminish compared to purchase price. My perfect Las Vegas Balanced Return property is a move up home in a good area near Red Rock or Green Valley Ranch. Ideally it is 2400SF, single storey when possible, 4 bedrooms, 3 baths, (one bed and bath MUST be downstairs if 2 storey), 2 master bedrooms if possible, 3 car garage or RV parking, private back yard with pool, spa, covered patio, facing north/south with as many upgrades as possible! We’re not asking for much here .... so the goal is to get as many in that list as possible. Take a look at the BR Move Up home example. You’ll notice from the examples that these returns are still fantastic.

CAPITAL GAIN

Great views and large square footage available in this capital gain property

Capital gain-focused investments live at the other end of the scale. These homes are exceptionally desirable properties but not affordable for the majority of the market. But for those who can, ‘it’s living the dream’! And the dream comes at a cost that people who have the funds are sometimes willing to pay.

Capital Gain focused properties are the homes that always make or lose the most money in property market booms and crashes. They are thus the riskiest property sector to invest in. A home bought for $1 million may sell for $1.5M a few years later. Equally the $1.5M property may sit on the market for 12 months of longer and be sold at a steep discount if the economy changes.

Individuals looking for heavily Capital Gain (GC) focused investments are often higher net worth individuals, business owners with large incomes who also wish to reduce their tax liability and who will not be in the unfortunate position of having to sell at the wrong time.

The biggest drawback of Capital Gain focused properties is that they have low ROI's geared. They can take longer to rent and/or sell and rents may need to be significantly negotiated in a slow market.

Our perfect C6 focused property is in a gated community, on a golf course or on the water, is 3800SF+, has a min 5 bedrooms, study, games room, media room, wine cellar, 4 car plus RV, guest quarters, stunning views, pool with swim up bar, spa, sauna and a built-in stainless steel BBQ.

SO WHAT PROPERTY TYPE IS FOR YOU?

Knowing your personal and financial objectives allows you to focus on the correct blend of CF, BR, and C6 properties. It removes much of the fear from buying because you know the purpose of what you are doing and how your property purchase(s) are building towards your goals.

The section on Your Property Plan is suggested reading if you are still developing your plan. And keep in mind the thing I love most about property investments - Rental Income is virtually fixed to long term inflation rates, as rents increase over time. So your rental income retains its purchasing power over the lifetime of your investments.